Financial Life Cycle

Resources | Financial Life Cycle

- Details

- Parent Category: Financial Life Cycle

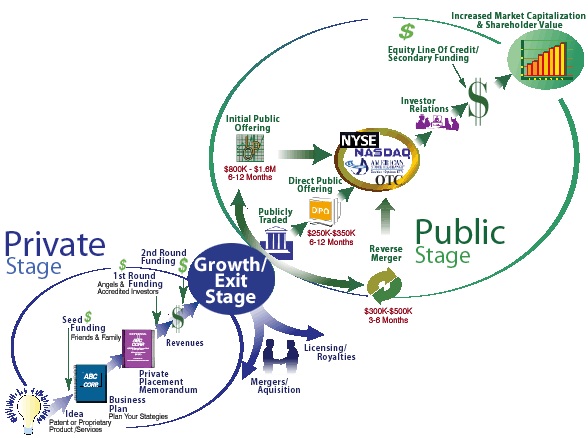

The Securities Industry can oftentimes seem overwhelmingly complicated and somewhat cumbersome. The Wall Street Organization, Inc. ® has the capabilities of guiding both startups and operating companies through the process of capital formation. The following resources compiled by The Wall Street Organization, Inc. ® have proven to be useful for the general guidance of those trying to understand the basics of this complex financial exercise.

Financial Life Cycle

A great idea, well-developed business strategy, key funding rounds and execution are critical components in the early stages of a company's development, ensuring the success and subsequent revenue of a new product or service. Once accomplished, growth and exit strategies should be explored to determine the company's appropriate path. It may be beneficial to merge or consider acquisition by an industry leader. Licensing and royalty arrangements could be prudent at this point and the company may be ideally suited for an IPO, DPO or Reverse Merger. Once on the exchange, a strong Investor Relations Program that delivers consistent and effective communication with your current and future stockholders is essential. Ultimately the goal in the public stage of a company's Financial Life Cycle is to increase the market capitalization and shareholder value.